Cryptocurrencies have taken the financial world by storm, transforming from obscure digital assets into a global phenomenon. If you’ve been captivated by stories of Bitcoin millionaires or the groundbreaking technology behind blockchain, you’re not alone. Investing in cryptocurrencies offers tantalizing rewards but also harbors significant risks. Let’s delve into this exciting world and uncover how you can navigate it wisely.

Understanding Cryptocurrencies

What Are Cryptocurrencies?

At their core, cryptocurrencies are digital or virtual currencies that use cryptography for security. Unlike traditional currencies issued by governments (fiat money), cryptocurrencies operate on a technology called blockchain, a decentralized ledger enforced by a network of computers worldwide.

Blockchain Technology Simplified

Imagine a ledger that records every transaction ever made, available for everyone to see but immutable once recorded. This transparency and security are the hallmarks of blockchain technology, making it revolutionary for various applications beyond just currencies.

The Rewards of Investing in Cryptocurrencies

1. Potential for High Returns

Cryptocurrencies like Bitcoin and Ethereum have experienced astronomical growth since their inception. Early adopters have seen returns that traditional investments rarely match. The volatile nature of crypto markets means there are opportunities for significant gains.

Example: In 2010, Bitcoin was worth mere cents; by 2021, it soared to over $60,000 per coin.

2. Diversification Benefits

Adding cryptocurrencies to your investment portfolio can provide diversification, potentially reducing overall risk. Crypto assets often have a low correlation with traditional asset classes like stocks and bonds.

3. Innovation and Adoption

Investing in cryptocurrencies means being part of a technological revolution. Innovations like Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) are reshaping industries from finance to art.

The Risks of Investing in Cryptocurrencies

1. Market Volatility

Cryptocurrency prices can fluctuate wildly in short periods. This volatility can lead to significant financial losses if not managed properly.

Example: Bitcoin’s price dropped by over 50% within months in multiple instances.

2. Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies. Changes in laws and regulations can impact crypto values and your ability to trade.

3. Security Risks

Despite blockchain’s security, individual investors face risks like:

- Hacks and Cyber Attacks: Exchanges and wallets can be vulnerable.

- Scams and Fraud: Phishing schemes and fraudulent ICOs (Initial Coin Offerings).

4. Lack of Intrinsic Value

Unlike stocks, cryptocurrencies don’t represent ownership in a company. Their value is often driven by supply and demand dynamics, which can be speculative.

5. Technological Risks

The crypto space is rapidly evolving. New technologies might render existing ones obsolete. Issues like network congestion and high transaction fees can also affect usability.

How to Invest in Cryptocurrencies

1. Educate Yourself

Before diving in, immerse yourself in learning:

- Understand Blockchain Technology: Grasp the basics of how it works.

- Study Different Cryptocurrencies: Each has unique features and purposes.

Tip: Resources like online courses, webinars, and forums can be invaluable.

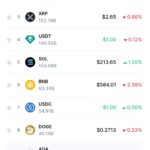

2. Choose the Right Cryptocurrency

There are thousands of cryptocurrencies. Consider factors like:

- Market Capitalization: Larger cap coins like Bitcoin and Ethereum are considered more stable.

- Use Case and Technology: Does the cryptocurrency solve a real-world problem?

- Community and Development Team: Active communities and strong leadership can be positive signs.

3. Select a Reputable Exchange

Exchanges are platforms where you can buy, sell, or trade cryptocurrencies.

- Security Measures: Look for exchanges with robust security protocols.

- User Experience: An intuitive interface can make trading easier.

- Fees: Be aware of transaction and withdrawal fees.

Popular Exchanges: Coinbase, Binance, Kraken.

4. Secure Your Investments

a. Wallets

- Hot Wallets: Online wallets accessible via the internet. Convenient but more vulnerable to hacks.

- Cold Wallets: Offline wallets like hardware devices. Offers enhanced security.

Recommendation: Use a cold wallet for long-term holdings.

b. Enable Two-Factor Authentication (2FA)

Always enable 2FA on your exchange accounts and wallets to add an extra layer of security.

5. Develop an Investment Strategy

a. Determine Your Investment Goals

- Long-Term Holding (HODLing): Investing with a long-term perspective.

- Active Trading: Taking advantage of market volatility for short-term gains.

b. Dollar-Cost Averaging

Investing a fixed amount regularly can mitigate the impact of volatility, averaging out the purchase price over time.

6. Start Small

Begin with an amount you’re comfortable losing. The crypto market can be unpredictable, and it’s wise to test the waters first.

Managing Risks

1. Diversify Your Portfolio

Don’t put all your eggs in one basket. Investing in a mix of cryptocurrencies can spread risk.

2. Stay Informed

The crypto space moves quickly. Keeping up with news, updates, and market trends can help you make informed decisions.

3. Be Wary of Scams

- Avoid “Get Rich Quick” Schemes: If it sounds too good to be true, it probably is.

- Verify Authenticity: Double-check websites and communication channels.

4. Understand Tax Implications

Cryptocurrency transactions may be subject to taxes on capital gains. Consult with a tax professional to ensure compliance.

5. Set Stop-Loss Orders

If you’re trading actively, use stop-loss orders to automatically sell when prices drop to a certain level, limiting potential losses.

The Bigger Picture: Beyond Investment

Embracing the Technology

Investing in cryptocurrencies isn’t just about potential profits; it’s about participating in a technological evolution. Blockchain technology promises to transform industries ranging from finance to supply chain management.

Environmental Considerations

Be aware of the environmental impact of certain cryptocurrencies, particularly those that require significant energy for mining. This has led to a push towards more sustainable practices and the development of eco-friendly cryptocurrencies.

Regulatory Developments

Regulations are evolving. Governments are exploring Central Bank Digital Currencies (CBDCs), which could reshape the crypto landscape. Staying informed about regulatory trends can help you anticipate market shifts.

Conclusion

Investing in cryptocurrencies offers a unique blend of high-risk and high-reward opportunities. By educating yourself, adopting sound investment strategies, and staying vigilant about security and market developments, you can navigate this exhilarating space more confidently.

Remember, the key is to balance ambition with caution. Cryptocurrencies can be a valuable addition to a diversified investment portfolio, but they should align with your financial goals and risk tolerance.

Additional Resources and Next Steps

- Educational Platforms: Websites like Coursera and Udemy offer courses on blockchain and cryptocurrency.

- Crypto Communities: Join forums like Reddit’s r/CryptoCurrency or attend local meetups.

- Podcasts and Newsletters: Stay updated with reliable sources like Coindesk, Cointelegraph, or podcasts like “Unchained” by Laura Shin.

- Consult Financial Advisors: Consider speaking with a professional familiar with cryptocurrencies.

Embarking on the cryptocurrency journey is as thrilling as it is complex. Whether you’re captivated by the technological innovation or the investment potential, taking the time to understand the landscape will serve you well. Who knows? This might just be the dawn of a new chapter in your financial adventure.

Previous Post

Previous Post Next Post

Next Post